“Discover The Fortune That’s Hidden In Your Business When You Can Obtain More Capital.”

LINE OF CREDITIn the vibrant city of Elkhart, Indiana, where businesses and individuals navigate the ebb and flow of financial needs, Elkhart Business Loans emerges as a financial ally, offering a diverse array of lending solutions. Among its comprehensive suite of services, Elkhart Business Loans proudly introduces lines of credit, providing residents with a dynamic and flexible financial tool to address varying financial demands.

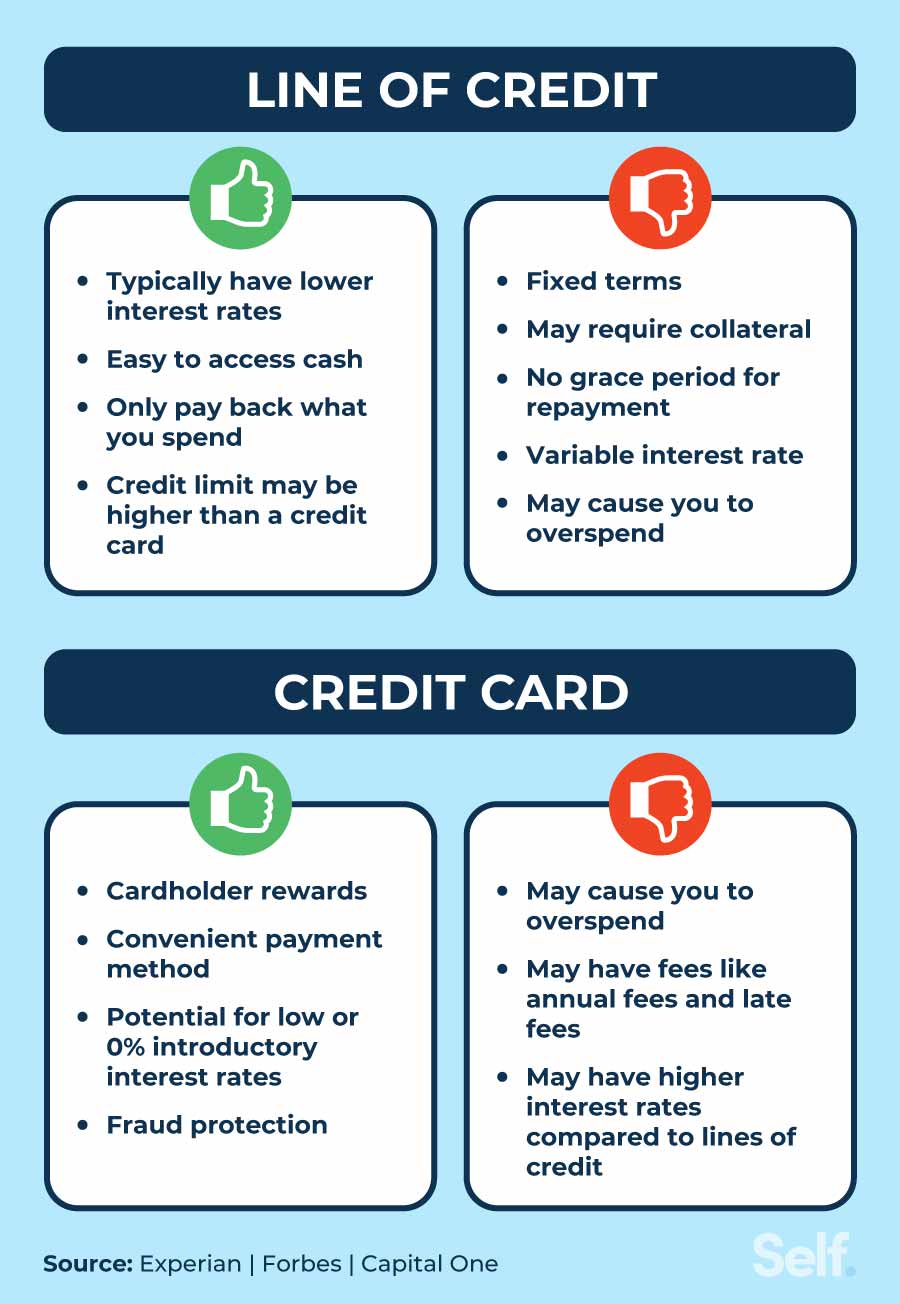

A Dynamic Financial Solution Lines of credit are a versatile financial tool that allows individuals to access funds up to a predetermined credit limit. Elkhart Business Loans recognizes the dynamic nature of financial needs and introduces lines of credit to provide residents with a readily available source of capital, offering flexibility to draw funds as needed. How Lines of Credit Work Elkhart Business Loans' lines of credit operate on the premise of pre-approved credit limits. Once approved, borrowers have the flexibility to draw funds as required, up to the predetermined limit. Interest is typically only charged on the amount borrowed, offering a cost-effective solution for those seeking financial flexibility without committing to a lump-sum loan. |

|

... And you won't believe how quick and easy it is to claim.

Tailored to Your Needs

Elkhart Business Loans understands that financial needs vary widely among individuals. Whether it's managing fluctuating business expenses, covering unexpected personal bills, or taking advantage of time-sensitive opportunities, lines of credit cater to diverse needs. This flexibility allows borrowers to navigate their financial journey with agility, ensuring that they have access to funds when required.

Streamlined Application Process

Recognizing the importance of a user-friendly process, Elkhart Business Loans has streamlined the application process for lines of credit. Applicants can initiate the process online, providing necessary details to assess eligibility. This efficient approach minimizes paperwork and accelerates the approval process, allowing borrowers to access their line of credit promptly.

Responsible Borrowing

Elkhart Business Loans emphasizes responsible borrowing with lines of credit. While the flexibility to draw funds as needed is a valuable feature, borrowers are encouraged to use their lines of credit judiciously. Responsible borrowing ensures that individuals can effectively manage their financial commitments and leverage the benefits of this dynamic financial tool without unnecessary strain.

Elkhart Business Loans understands that financial needs vary widely among individuals. Whether it's managing fluctuating business expenses, covering unexpected personal bills, or taking advantage of time-sensitive opportunities, lines of credit cater to diverse needs. This flexibility allows borrowers to navigate their financial journey with agility, ensuring that they have access to funds when required.

Streamlined Application Process

Recognizing the importance of a user-friendly process, Elkhart Business Loans has streamlined the application process for lines of credit. Applicants can initiate the process online, providing necessary details to assess eligibility. This efficient approach minimizes paperwork and accelerates the approval process, allowing borrowers to access their line of credit promptly.

Responsible Borrowing

Elkhart Business Loans emphasizes responsible borrowing with lines of credit. While the flexibility to draw funds as needed is a valuable feature, borrowers are encouraged to use their lines of credit judiciously. Responsible borrowing ensures that individuals can effectively manage their financial commitments and leverage the benefits of this dynamic financial tool without unnecessary strain.

With the right loan we can help business owner just like you turn big profits.

Transparent Terms and Conditions

Transparency is paramount in Elkhart Business Loans' commitment to ethical lending. The terms and conditions of lines of credit are communicated clearly to borrowers upfront. Details such as the credit limit, interest rates, and repayment terms are provided transparently, ensuring that borrowers have a comprehensive understanding of their financial arrangement.

Community-Centric Approach

As a local financial institution, Elkhart Business Loans takes pride in its community-centric approach. The introduction of lines of credit is rooted in an understanding of the unique financial landscape of Elkhart. By offering a flexible and accessible financial tool, Elkhart Business Loans aims to empower residents to navigate their financial journey with confidence, contributing to the overall economic well-being of the community.

Transparency is paramount in Elkhart Business Loans' commitment to ethical lending. The terms and conditions of lines of credit are communicated clearly to borrowers upfront. Details such as the credit limit, interest rates, and repayment terms are provided transparently, ensuring that borrowers have a comprehensive understanding of their financial arrangement.

Community-Centric Approach

As a local financial institution, Elkhart Business Loans takes pride in its community-centric approach. The introduction of lines of credit is rooted in an understanding of the unique financial landscape of Elkhart. By offering a flexible and accessible financial tool, Elkhart Business Loans aims to empower residents to navigate their financial journey with confidence, contributing to the overall economic well-being of the community.

You've worked hard your whole life—isn't it time to stop and smell the roses?

Supporting Business and Personal Goals

Elkhart Business Loans' lines of credit serve as a bridge between immediate financial needs and long-term financial goals. For businesses, this financial tool can assist in managing cash flow, covering operational expenses, and seizing growth opportunities. On a personal level, lines of credit offer the flexibility to address unexpected bills, fund home improvements, or pursue personal ventures.

In conclusion, Elkhart Business Loans' introduction of lines of credit signifies a commitment to providing residents of Elkhart with a dynamic and flexible financial solution. The accessibility, transparency, and community-centric focus of lines of credit from Elkhart Business Loans position them as a reliable source of financial support. Whether it's navigating business challenges or addressing personal financial needs, lines of credit empower individuals to manage their finances with agility, unlocking a world of possibilities on their financial journey.

Elkhart Business Loans' lines of credit serve as a bridge between immediate financial needs and long-term financial goals. For businesses, this financial tool can assist in managing cash flow, covering operational expenses, and seizing growth opportunities. On a personal level, lines of credit offer the flexibility to address unexpected bills, fund home improvements, or pursue personal ventures.

In conclusion, Elkhart Business Loans' introduction of lines of credit signifies a commitment to providing residents of Elkhart with a dynamic and flexible financial solution. The accessibility, transparency, and community-centric focus of lines of credit from Elkhart Business Loans position them as a reliable source of financial support. Whether it's navigating business challenges or addressing personal financial needs, lines of credit empower individuals to manage their finances with agility, unlocking a world of possibilities on their financial journey.

You can laugh at money worries—if you're accepted.